How Risk Management Enterprise can Save You Time, Stress, and Money.

Wiki Article

Facts About Risk Management Enterprise Revealed

Table of ContentsThe Risk Management Enterprise StatementsWhat Does Risk Management Enterprise Do?All about Risk Management EnterpriseThe 5-Minute Rule for Risk Management EnterpriseA Biased View of Risk Management EnterpriseNot known Details About Risk Management Enterprise The Definitive Guide to Risk Management Enterprise

By leveraging a proactive outlook and thoroughly considering different circumstances, you're able to have a far better grasp on potential risks that your organization can encounter. When you have an understanding and clear overview, you can make a decision exactly how to proceed to align activities with service objectives. In doing so, you create and cultivate a society that is not terrified of dangers, in addition to one that runs with both dexterity and durability.With a solid danger management technique, you're presenting your level of treatment and objective to stakeholders, which types confidence - Risk Management Enterprise. By recognizing threats, leaders and monitoring teams can appropriately allocate sources to ideal manage future outcomes. This includes economic sources, along with exactly how to designate responsibilities to different people within your group in order to finest perform and handle the chosen plan of activity

Some Known Details About Risk Management Enterprise

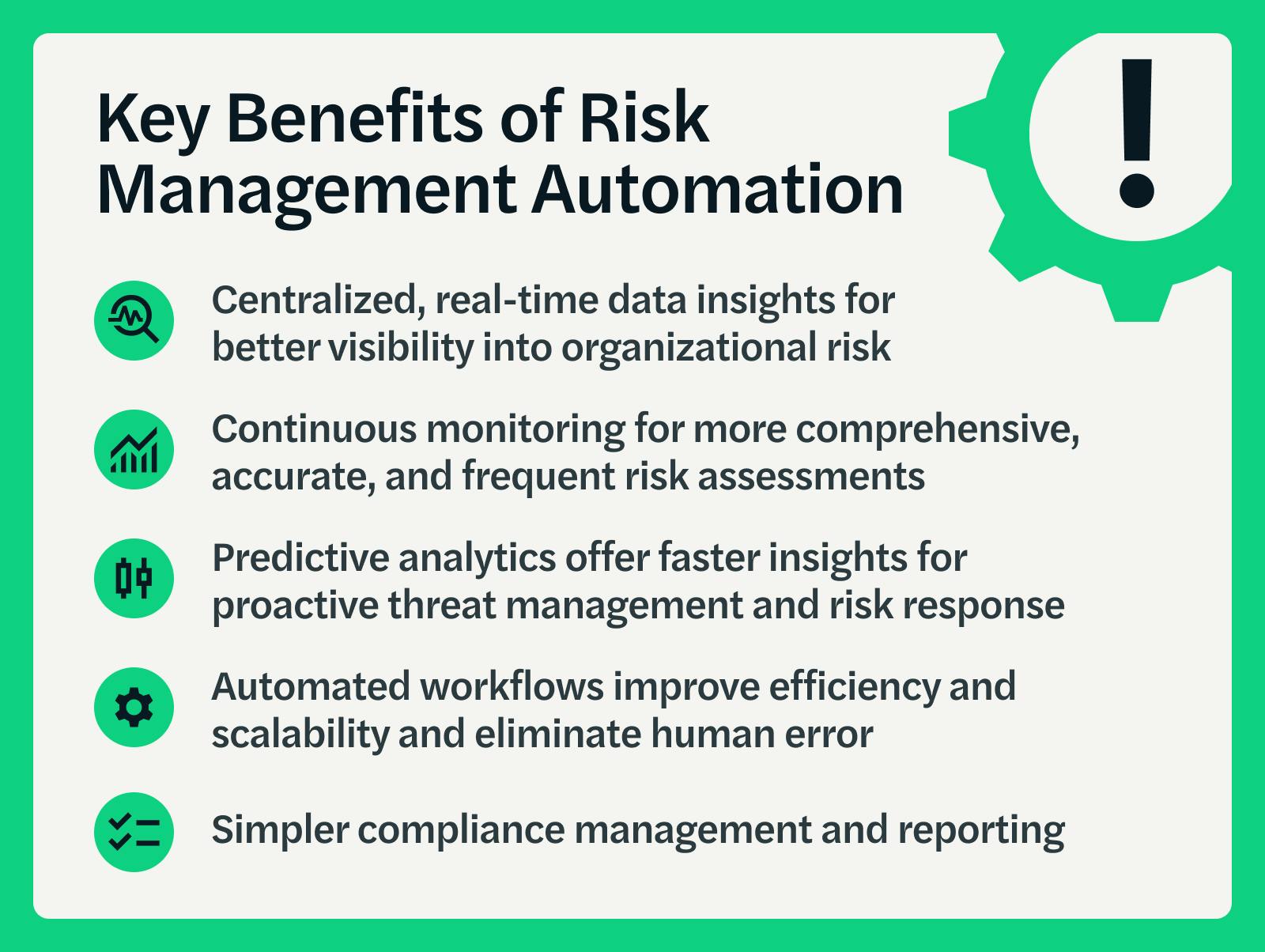

With automation software, you can rest ensured that you'll have all your firm's data nicely systematized and ready-to-use for evaluation or reference. While the intricacies of every organization's danger monitoring strategy will certainly vary, there are best techniques worthwhile to think about and follow to successfully exercise danger monitoring.A little error can trigger major damage, especially in highly managed sectors like finance. And, also if all individuals remain in area and trained, mistakes take place that can be due to bad governance. Risk Management Enterprise. That's why it is necessary to have reputable software application, typical methods, and oversight in position to protect your business versus mishaps and mistakes

Risk management is vital to company success-- probably extra so currently than ever before. The dangers that modern-day organizations encounter have grown much more complex, sustained by the fast rate of globalization.

Some Known Details About Risk Management Enterprise

Numerous companies are still grappling with several of the risks posed by the COVID-19 pandemic. That includes the recurring demand to handle remote or hybrid work atmospheres and what can be done to make supply chains much less vulnerable to disruptions. Consequently, a danger monitoring program must be intertwined with organizational strategy.

Here's a guide on threat direct exposure in a company and just how it's calculated. Several professionals note that taking care of danger is a formal function at business that are heavily regulated and have a risk-based business model.

Indicators on Risk Management Enterprise You Need To Know

For various other markets, danger has a tendency to be much more qualitative. That raises the need for an intentional, complete and consistent technique to run the risk of monitoring, stated Gartner method vice president Matt Shinkman, that leads the consulting company's danger management and audit methods.Display the outcomes of threat controls and readjust as essential. These actions sound uncomplicated, however risk management boards set up to lead efforts should not ignore the job needed to finish the procedure.

They likewise record risk action strategies, risk proprietors and stakeholders, and the expense of taking care of risks. A downloadable risk register template can be found in the write-up linked to above. Companies can obtain these advantages by using a threat register as component of their threat monitoring programs. As federal government and industry conformity policies have expanded over the previous 20 years, regulative and board-level scrutiny of company risk administration techniques have additionally raised.

Strategy and objective-setting. Details, interaction and coverage. ISO 31000.

The 3-Minute Rule for Risk Management Enterprise

The more recent version additionally emphasizes the important duty of senior management in danger programs and the integration of risk administration methods throughout the company. Some nationwide criteria bodies and groups have also launched country-specific variations of ISO 31000. As an example, the American National Standards Institute supplies a variation that's supervised by the American Culture of Safety Professionals.Risk averse is an additional quality of organizations with typical danger management programs. For numerous companies, "risk is an unclean four-letter word-- which's unfavorable," Valente said. "In ERM, risk is taken a look at as a tactical enabler versus the price of operating." "Siloed" vs. alternative is just one of the large distinctions in between the two methods, according to Shinkman.

Traditional risk monitoring likewise often tends to be responsive. In business risk administration, handling threat is a collaborative, cross-functional and big-picture initiative.

Risk Management Enterprise - Truths

The former job at firms that see risk monitoring as an insurance coverage, according to Forrester. Transformational CROs concentrate on their company's brand name track record, understand the horizontal nature of threat and view ERM as a means to make it possible for the "proper quantity of danger required to expand," as Valente placed it.

A lot more confidence in organizational goals and goals since threat is factored into technique. A competitive advantage over service rivals with less mature danger monitoring programs.

Raising risk recognition is a crucial component of threat administration. The interaction strategy developed by danger leaders have to properly convey the company's risk plans and procedures to workers and other pertinent celebrations.

What Does Risk Management Enterprise Do?

Establishing the range and context. This read more action requires specifying both the organization's risk appetite and threat resistance. The latter term describes just how much the dangers connected with particular efforts can differ from the overall risk cravings. Aspects to think about here consist of business purposes, firm culture, regulative requirements and the political atmosphere, amongst others.Report this wiki page